“Trade Republic’s team impressed us with its vision, beautiful product, strong traction and clear potential to become the European leader for mobile smart investing,” said Luca Bocchio, a partner at Accel, in a statement. The opportunity is ripe for the taking, and investors believe startup’s bid to be one to take it is a viable one. (It launched a waiting list for the service last year.) It’s not the only company in this area, though: Revolut, another fintech leader out of Europe, also launched trading in a limited release last August. and seems to have pushed back its plans for its UK launch, which would have been its first international move. Notably, Robinhood has not expanded outside the U.S. There is also a bit of open water right now. “We focus on more mature and secure asset classes.” Also, there are no plans for crypto-trading, he added. “On paper the offering might look similar but the positioning is very different,” Hecker said, pointing to the stable asset classes that Trade Republic focuses on, and the fact that it will be moving into savings. Expanding into new countries is one of the toughest things for a fintech startup to do, and that may well be compounded in cases where the platform is potentially leading to billions of dollars of trading. It’s very squarely focused on European growth and doing so in a way that will not fall afoul of strict financial regulations. The company was founded five years ago and spent the first four of those in stealth, obtaining licenses to trade and operate as a bank and building its platform.

I’d argue that fintech, and Trade Republic, is not quite in that category, though. (They succeeded to some extent, selling companies to Groupon, eBay and others over the years.)

There was even a “startup factory”, Rocket Internet, led by the Samwer brothers, set up to found and grow multiple companies on this principle. counterpart might eventually even acquire to save itself the hassle of organic international expansion. counterpart, sometimes built with the aim of creating a regional leader that the U.S. There has long been a theme in European startup land around the idea of “clones.” These are businesses that are founded more or less based very closely or even exactly on the same model as a slightly older and successful U.S. This round, in that context, is a vote of confidence for Trade Republic that speaks to what shape fintech and how we as consumers interact with it might take in the years to come. With everyone staying indoors, some losing jobs, and many businesses being asked to remain closed to contain outbreaks, the measures have led to a slump in the economy, and it’s hard to see right now how much of that effect will be temporal or permanent.

#Outbank trade republic series#

We see saving as our biggest growth path in the years to come.”Įven without the milestone of this being a big Series B, this is a significant round of funding for another reason.Įveryone is watching how tech startups, fintech, and investing overall - remember, stock markets the world over have taken a nosedive in the wake of COVID-19, catching their own form of the virus - will fare right now. “We plan to introduce a sequence of savings features in the next couple of months. “We want to be the one-stop shop for trades, and we want to grow that as a safe space,” said Christian Hecker, co-founder and CEO of Trade Republic, in an interview this week. It’s currently available in Germany and Austria, with plans to add more countries soon.

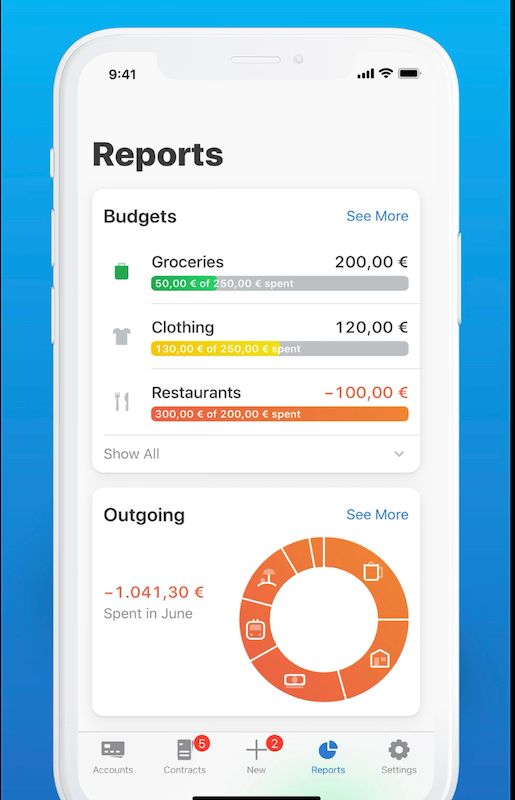

It has picked up more than 150,000 customers in that time, collectively managing more than €1 billion through the app. This is one of the largest Series B rounds for a fintech startup in the region and comes on the heels of the company’s commercial launch last year. (Its Series A last year was led by Creandum.) It’s not disclosing its valuation right now. The Series B is being co-led by Accel and Founders Fund, and it brings the total raised by the Berlin-based startup to just over €80 million. Trade Republic - which lets people buy and sell shares, exchange-traded funds (ETFs) and derivatives by way of a mobile app, paying just €1 ($1.09) in fees (no commission) - is today announcing the it has closed €62 million ($67 million at today’s rates) in funding to expand its business into more markets in Europe and to move into adjacent business lines in the near future. Now a startup out of Germany built on a similar premise is announcing a big round of funding from some top investors to continue its growth. In the U.S., Robinhood has led the charge in upending the stock investing model through its mobile-first, minimal-step, commission-free trading platform.

0 kommentar(er)

0 kommentar(er)